Community Foundation Of Tampa Bay Sees Surge In Donations, Ability To Help Others

An end-of-year boost in donations plus recent increases in stock market investments raise the assets of the Community Foundation of Tampa Bay to $145 million, along with its potential for making a difference in the community.

A recent surge in donations and a rebounding stock market could mean a banner year for the charities and community organizations funded by the Community Foundation of Tampa Bay.

The Community Foundation is a nonprofit, tax-exempt organization that administers endowment funds established by other nonprofit organizations, private foundations, corporations and individuals. Since 1990, its mission has been to build a better community through creative philanthropy, says President and CEO David Fischer.

Donations at the end of 2010 boosted the foundation’s assets to $145 million, says Beverley McLain, vice president of philanthropic services. The foundation’s assets were worth about $130 million at the end of the last fiscal year on June 30, 2010, according to its annual report.

“This may be an indicator of a turn in the economy, their [the donors’] outlook, and certainly in terms of giving,” she says.

Fischer calls the end-of-December rise in donations “typical,” noting, that “if it’s a good stock and you give it to us, there’s no capital-gains tax,” he says.

Because many donors specify the amounts and the charities to which the foundation gives, he hesitated to say whether this influx would result in a greater number of grants.

“They might grant out 10 percent; they might grant out nothing. It’s tough to predict. But it’s a good indicator that our grants will pick up,” he says.

Some donors do not specify a particular charity but instead contribute to the foundation’s community-impact fund, allowing the foundation’s board of trustees to determine where the money should be spent, he says. Any 501(c)3 or entity that qualifies as a tax deduction (such as a church or a school) can receive a grant.

Growing Influence Among Foundations

The Gulf Coast Community Foundation of Venice in Sarasota County is the largest of the state’s 26 community foundations — but although comparatively young, the Community Foundation of Tampa Bay has grown fast, McLain says. In asset value, it ranks among the top five of Florida’s community foundations and among the top 100 out of more than 700 nationwide.

It also receives high marks for its efficiency from Charity Navigator, a group that evaluates charities nationwide based on the percentage of money reserved for programs versus fund-raising and administrative costs. The foundation’s annual report states that its operating expenses in the fiscal year that ended June 30 were $1,008,563, less than 1 percent of its total net assets.

A minimum of $10,000 establishes an endowment fund, Fischer says. In addition to more than 600 family funds, the foundation manages about 160 funds for agencies such as the David A. Straz Center for the Performing Arts and the University of Tampa. The agencies each year receive 5 percent of their asset balances.

As of June 30, the foundation had given $9 million in grants, the annual report states. These included $7,500 to provide extracurricular activities and computer access to a mentoring program for families at risk of homelessness, $5,390 to purchase computers for a community center serving about 200 girls ages 10 to 18, and $2,500 to provide a free shot clinic and license tags for 1,000 cats and dogs in disadvantaged neighborhoods.

Making A Difference In Community

Other grant beneficiaries last fiscal year included:

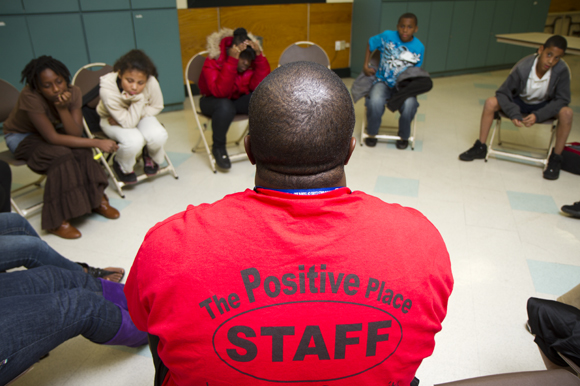

— The YMCA Community Learning Center at Sulphur Springs Elementary School, which has increased parental and community involvement and elevated the school to “five-star school” status;

— Ready For Life, a partnership in Pinellas County to help foster children successfully transition to adulthood by learning financial management, setting up an apartment, and other life skills;

— H.Y.P.E., or Helping Young People Excel, a gang- and delinquency-prevention program of the Boys & Girls Clubs of Tampa Bay that provides artistic, teamwork, learning and volunteer activities;

— About 14 agencies across Pasco and Hernando counties needing food, educational resources, transportation costs and personal-finance training.

The foundation uses an outside investment-consulting firm and an investment committee to manage its assets.

“We are prudent, long-term investors,” McLain says. “We take our stewardship very seriously.”

During the rocky economy, the investment committee advised to stay the course in the stock market instead of converting to cash in order to recover its assets. The committee did change its asset allocation, the annual report states.

That advice seems to have paid off, but “it was like a roller coaster,” Fischer says. “It’s tough to do because it’s nerve-racking.”

Valerie Kalfrin is a writer in Lutz whose 14-month-old son enjoys playing with plastic coins and a musical piggy bank. Comments? Contact 83 Degrees.